Less than two months before Christopher ‘Chris’ Pettit’s San Antonio law firm collapsed amid allegations he stole millions of dollars from clients, he completed a series of real estate deals particular.

He has sold at least seven properties in the San Antonio area to the same buyer, Sin Reposo LLC. Among them was Pettit’s main law office building at 11902 Rustic Lane.

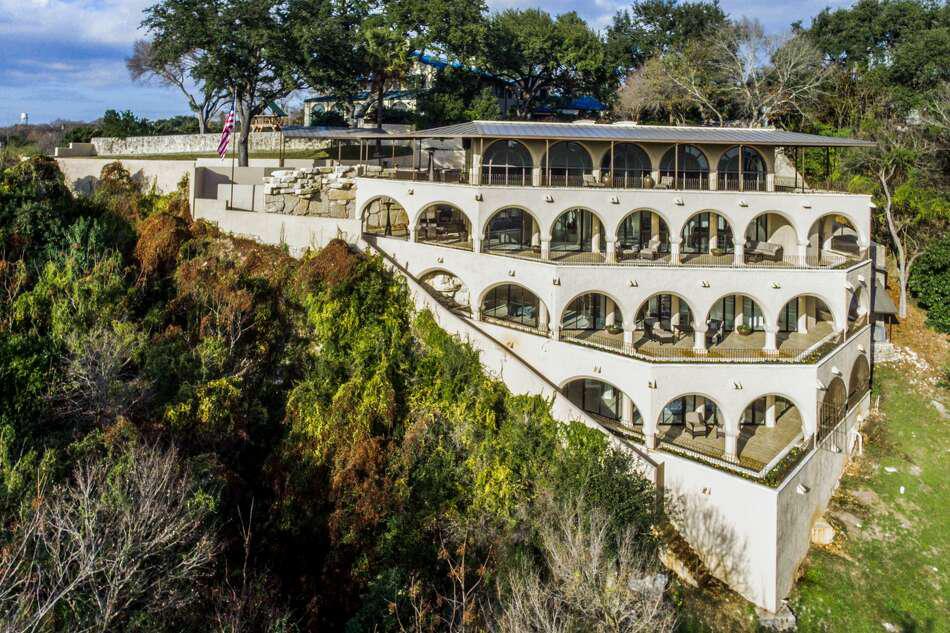

Sin Reposo has also entered into an option to purchase from Pettit the mansion at 555 Argyle Ave. in Alamo Heights overlooking the Olmos Dam, according to a filing this week in bankruptcy court.

Additionally, the company acquired the property at 200 Alameda Circle in Olmos Park from Pettit in January.

In total, the nine properties are valued at over $10 million.

The sole member and director of Sin Reposo is Garrett Glass, who is also chief financial officer of EF EnergyFunders Inc., an oil and gas investment firm based in Calgary but with executive offices in San Antonio. He appointed him to the post in March.

Pettit had a connection to EnergyFunders until allegations that he looted customers became public knowledge. On May 20, a day after the Express-News first reported his legal troubles, Pettit resigned from the board of directors of EnergyFunders, a penny stock company that trades on the Stock Exchange. TSX growth in Canada.

More than a dozen lawsuits were filed against Pettit and his law firm Chris Pettit & Associates before the two filed for Chapter 11 bankruptcy on June 1. Pettit listed $27.8 million in assets and $115.2 million in debt in his personal bankruptcy, making it one of the largest on record in San. Antonio. Bankruptcies put an end to litigation.

“Ponzi scheme”

Pettit operated a “Madoff-style Ponzi scheme for years,” the bankruptcy court filing alleged. Bernard “Bernie” Madoff orchestrated the largest such scheme in history, resulting in combined reported losses of nearly $65 billion for thousands of victims. He died in prison last year at age 82.

Pettit had already given up his attorney’s license when the bankruptcies were filed and the allegations against him sparked an FBI investigation. He was an estate planning and personal injury lawyer.

It could not be determined why Pettit entered into the transactions with Sin Reposo or how they were structured. Two of his attorneys did not respond to a request for comment.

In his filings, Pettit did not say he had a stake in Sin Reposo.

“It seems questionable,” San Antonio bankruptcy attorney Steven G. Cennamo, who is not involved in the case, said of the transfers. “You have to watch it. The question is whether there is a problem. »

In individual bankruptcy petitions, debtors must complete a statement of financial affairs. One of the questions on the form asks if the debtor has sold or transferred property to anyone within two years of filing for bankruptcy.

Pettit answered “yes” but made no mention of the properties being given to Sin Reposo. He signed the form under penalty of perjury that his answers were correct.

“On the eve of filing (bankruptcy), he makes all these transfers, does not disclose them under oath – and the guy is a lawyer. He knows it needs to be disclosed,” said Martin Seidler, a San Antonio bankruptcy attorney representing creditors in the case. “He made a false statement under oath.”

Other omissions?

Seidler wants U.S. Chief Bankruptcy Judge Craig Gargotta to order Pettit to change his bankruptcy schedules and state of financial affairs within 10 days of a court order.

The judge is due to consider Seidler’s request on Monday.

Seidler alleges that Pettit omitted numerous other information, including the transfer of two vehicles – a Mercedes and a Porsche – to his friend and accountant.

Among the properties transferred by Pettit to Sin Reposo were:

• A house at 711 Contour Drive in Olmos Park. It is valued by the Bexar appraisal district at nearly $1.9 million.

• Property at 200 Alameda Circle valued at $1.8 million. The house that stood on the property was demolished.

• An apartment building at 488 E. Olmos Drive valued at nearly $594,000.

• A house at 772 Lakebreeze Drive in Canyon Lake worth $1.2 million.

• His law office building valued at $450,000.

Confusingly, Pettit indicated in his property listing that he owned or had an interest in the law firm building and the Canyon Lake home.

In the same chart, Pettit valued the mansion at 555 Argyle — which Sin Reposo has an option to buy — at $3.6 million.

Transfer schedule

The transfers took place around the time some of Pettit’s clients won huge court judgments against him and his company. A couple in the spring were awarded approximately $908,000 in actual damages and $500,000 in punitive damages in San Antonio District Court. The defendants “knowingly and intentionally committed theft”, according to the judgment of April 6.

A small group of creditors received a $2.4 million judgment April 18 in Bexar County probate court.

The sales will likely be reviewed by San Antonio attorney Eric Terry, who has been named a Chapter 11 administrator. His duties will include hiring professionals to trace client assets and funds.

Since Pettit did not disclose the sales on his bankruptcy form, it is unclear if he received anything in return or what he may have done with the proceeds. This information should be declared on the form.

Terry will probably want to know if Pettit received “reasonably equivalent value” in exchange for selling the properties to Sin Reposo.

If he didn’t, or if the transactions are found to be fraudulent because they were to keep money out of the bankruptcy, then under the bankruptcy code Terry could “avoid any transfer” of property within two years of filing for bankruptcy.

In addition to his roles at Sin Reposo and EnergyFunders, Glass is a director of Source-Texas LLC. He plans to develop a 600-unit apartment complex just off Interstate 10 in the Scenic Loop-Boerne Stage Corridor.

Glass listed Sin Reposo’s address in state business records as his home in Olmos Park. He did not respond to messages seeking comment.