Default activity in the US leveraged loan market revived in August after bankruptcy filings by four Morningstar LSTA US Leveraged Loan Index issuers pushed $4.46 billion in debt from institutional loan to non-performing status.

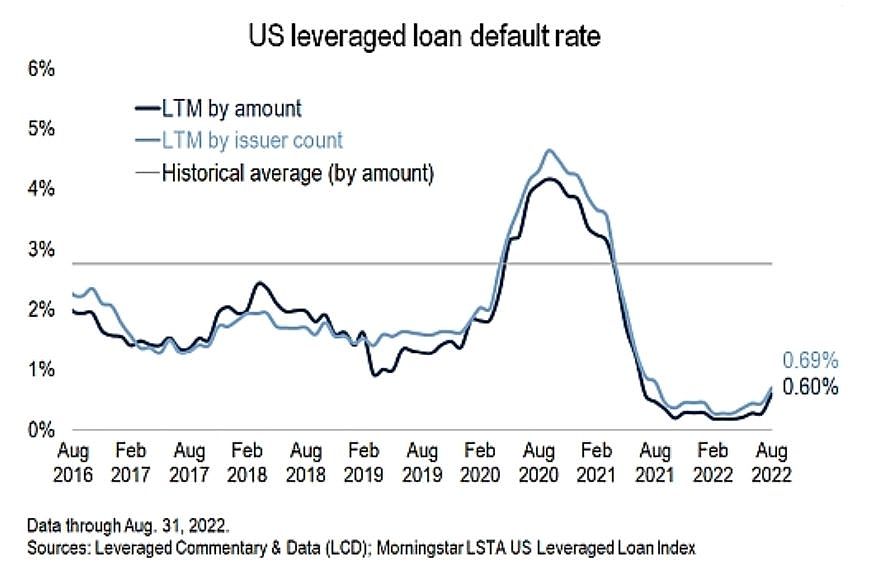

After historic lows, the index’s default rate fell to 0.69% by number of issuers and 0.60% by amount, from 0.43% and 0.28% respectively in July.

There was more defaulted loan volume in August than in the previous 17 months combined.

Leader in size among the default indices, international endo filed for Chapter 11 protection in the Southern District of New York Bankruptcy Court to reduce its debt and settle lawsuits stemming from its alleged role in the opioid epidemic in the United States.

The drugmaker’s Term Loan B, placed in 2021 to refinance existing debt, had $1.975 billion outstanding at the time of filing, marking the largest issuer default since SeaDrill Partners‘ $2.6 billion loan in July 2020.

According to Endo International’s Chapter 11 petition, the company has total assets of $6.33 billion and total debts of $9.54 billion. The shareholders listed on the petition include The Vanguard Group, with a 12.07% stake; BlackRock, with a 7.93% stake; Paulson & Co., with a 7.37% stake; and Renaissance Technologies, with a 7.07% stake.

Endo’s India-based entities are not part of the Chapter 11 proceeding, the company said, adding that it plans to file recognition proceedings in Canada, the United Kingdom and Australia.

The drug company is the latest in high-profile Chapter 11 filings to address opioid claims. Of the other loan index issuers, Mallinckrodt recently emerged from bankruptcy after placing $1.9 billion in index-linked loans into bankruptcy in October 2020.

Also under the umbrella of Health, Medical Imaging Society Carestream Health filed for bankruptcy in the District of Delaware. The recapitalization envisioned by the pre-packaged plan will eliminate about $470 million in debt. The Carestream term loan had $507.7 million outstanding, according to court documents.

Citing rising printing costs and reduced mail demand, OSG Billing Services filed for Chapter 11 bankruptcy with a plan that would leave all creditors intact or with assessed recovery at 100%.

According to the company’s disclosure statement, the proposed plan of reorganization would amend and restate the company’s existing senior term loan, outstanding in the amount of approximately $599 million, with a slightly larger facility to an amount of $601.4 million. The restated loan would mature in June 2026, and the new interest rate would be an adjusted Sofr+225 bps (including 75 bps paid in cash and 150 bps paid in kind), subject to a Sofr floor of 1%, according to a term sheet attached to the company’s RSA, also filed with the commercial court.

Rounding out the busiest month for default business since July 2020, the fixture maker Lumileds filed for Chapter 11, citing challenges caused by supply chain constraints, Covid-related issues, and the dispute in Ukraine over the company’s excessive leverage. Lumileds, a developer and manufacturer of lighting products that primarily serve the automotive, smartphone, and industrial end markets, had $1.61 billion outstanding on its Term B loan maturing in 2024, according to court documents.

Imminent situation?

Looking at potential short-term situations, a UK-based cinema operator cineworld confirmed that it was considering a Chapter 11 filing in the United States and ancillary proceeding in other jurisdictions as part of a possible balance sheet restructuring.

Cineworld last warned of its ability to continue in business when it released its 2021 annual results in March. Among other headwinds — including the pandemic and competition from online movie streaming — the company is appealing more than $900 million in damages awarded to former merger partner Cineplex after it waived an agreement to buy the Canadian group in June 2020.

With $3.49 billion in loans across three facilities in the Loan Index, a Cineworld Chapter 11 filing would be the largest loan default by a single issuer since McDermott International placed $3.52 billion in term loans into bankruptcy in 2018.

In theory, a Cineworld default would bring August’s default rate (in amount) to 0.87%.

A potentially less immediate, but still urgent situation has emerged from the long-time loan originator Avaya. The telecommunications and software company – which entered the loan market for LBO financing in 2008 – has already made its way to Chapter 11. Once again, the company is warning of its ability to continue its operating after announcing a nearly 70% year-over-year decline in adjusted EBITDA in preliminary results for the third quarter of fiscal 2022, and at the same time announcing that it is working with advisers to evaluate options on its 2.25% convertible notes due June 2023. Avaya has three term loans in the Morningstar LSTA US Leveraged Loan Index totaling $1.89 billion.

More generally, stress indicators continue to increase, but remain well below long-term averages.

According to data from LCD, the “below 80” cohort of performing index loans has nearly doubled in the past six months, to $45 billion, but for context, at the height of the pandemic market crash in March 2020 , it skyrocketed to $672 billion.

August’s distressed volume translates to 3.19% performing loans in the Morningstar LSTA US Leveraged Loan Index. Although this is the highest month-end reading since October 2020, it is still well below the 10-year average of 4.23%.

In a latest measure of credit risk trends, downgrades outpaced upgrades for a third consecutive month (a 16-month upgrade cycle for the asset class was halted in June). On a rolling three-month basis, the downgrade of loan facilities in the Morningstar LSTA US Leveraged Loan Index topped upgrades of 1.89x in August, down from 1.74x in July and 1.32x in June.